franklin county ohio sales tax rate 2019

The Franklin County Sales Tax is 125. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

Map of current sales tax rates.

. You can print a 7 sales tax table here. This is the total of state and county sales tax rates. 3 rows Franklin County OH Sales Tax Rate.

If you need access to a database of all Ohio local sales tax rates visit the sales tax data page. There is no applicable city tax or special tax. 05 lower than the maximum sales tax in OH The 75 sales tax rate in Columbus consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax.

1 lower than the maximum sales tax in OH The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. Franklin County has been able to sustain General Fund revenue as a result of the Commissioners decision to maintain the one-quarter of one percent sales tax beginning in 2019 in response to the changes to sales tax on Medicaid Managed Care Organizations MCOs. Ad Find Out Sales Tax Rates For Free.

To learn more about real estate taxes click here. 2021 Property Tax Ratesfor 2022. The County sales tax rate is.

The effective tax rate was 18 percent in 2020 about the same in 2019 and 22 percent in 2015. Some cities and local governments in Franklin County collect additional local. The Ohio sales tax rate is currently.

In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer. Franklin County has the city of Columbus as its county seat and with a population of 13 million it is the most populous county in Ohio. The Ohio state sales tax rate is currently 575.

For the 1st quarter of 2020 Franklin County collected 821 million in sales tax which is 14 million or 17 below the 2020 estimate due to a 36 million refund resulting from an audit of transactions from 2014 2017 of a large IT vendor- The table below provides the comparison of the sa les tax estimates with the actual sales tax collections. The minimum combined 2021 sales tax rate for Franklin County Ohio is 75. Montgomery Countys sales tax rate will jump into the states third-highest spot when it rises a quarter percent on Monday joining Franklin County and.

The state sales and use tax rate is 575 percent. This is the total of state and county sales tax rates. Ohio has state sales tax of 575 and.

The Ohio state sales tax. ZIP County Rate ZIP County Rate ZIP County Rate ZIP County Rate County Rate Table by ZIP Code February 2022 43001 Licking 725 43002 Franklin 750 43003 Delaware 700 43003 Morrow 725 43004 Franklin 750 43004 Licking 725 43005 Knox 725 43006 Coshocton 725 43006 Holmes 700 43006 Knox 725 43007 Union 700 43008. The sales tax jurisdiction name is Columbus Cota Delaware Co which may refer to a local government division.

Fast Easy Tax Solutions. Michael stinziano 2019 property tax rates for 2020 franklin county auditor expressed in dollars and cents on each one thousand dollars of assessed valuation libr local city voc non business credit owner occupancy non business owner occupancy credit dst spec cnty twp school vill school total class 1 class 2 no. The Franklin County sales tax rate is 125.

What is Ohios sales tax rate for 2020. The Treasurer is the chief investment officer of the county responsible for the management of more than 1 billion in revenue annually. A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax.

Average Sales Tax With Local. 6 rows The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales. The sales and use tax rate for Paulding County 63 will increase from 675 to 725 effective January 1 2022.

Counties and regional transit authorities may levy. The minimum combined 2022 sales tax rate for Franklin County Ohio is. Ohio has 1424 cities counties and special districts that collect a local sales tax in addition to the Ohio state sales taxClick any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code.

The current total local sales tax rate in Franklin. 575 percent The state sales and use tax rate is 575 percent. The Franklin sales tax rate is.

The minimum combined 2022 sales tax rate for Franklin Ohio is. There is no applicable city tax. Safety liquidity and earning a market rate of return on the countys money are primary responsibilities of the Treasurer.

Sept 30 2018. - The Finder This online tool can help determine the sales tax rate in effect for any address in Ohio. This is the total of state county and city sales tax rates.

For tax rates in other cities see Ohio sales taxes by city and county.

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Ohio Sales Tax Rates By City County 2022

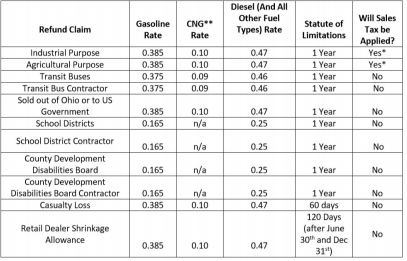

Ohio Raises Motor Fuel Taxes But Not On Everybody Lexology

Ohio Sales Tax Guide And Calculator 2022 Taxjar

Ohio Tax Rates Things To Know Credit Karma

Louisiana Sales Tax Rates By City County 2022

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled